Saturday, May 13, 2017

Romanian Dvorak layout - for Mac

I just put together a new keyboard layout for Romanian speakers based on Dvorak layout (using Ukelele). It is basically the Dvorak keyboard with logical positions for Romanian characters: ă, î, â, ș, ț in the same location as the english characters by pressing the option key.

ă = ⌥ + a

â = ⌥ + '

î = ⌥ + i

ș = ⌥ + s

ț = ⌥ + t

You can download it here.

For Mac users:

Save it as a .layout file and put in /Library/Keyboard Layouts.

Then go to System Preferences/Keyboard. Choose the input sources tab. Press the + button on the bottom left.

You will get a window that looks like this.

Choose Others and you will see the Dvorak-Romanian layout from the right pane.

Enjoy!

Keywords: Dvorak layout, Romanian, Tastatura Dvorak pentru Romania, Mac.

Wednesday, January 13, 2016

For a new beginning - mission statement

this is Alan again... I have neglected the blog for few years, but now I am back.

I have decided that I will post regularly. The topics that I will cover will be economics and human behavior, history, current affairs, paleo diet, working out, Dvorak layout. Unfortunately, tangential references to some people's religion, such as the cult of Mythras, will have to be made from time to time... they insist.

I will be brief. Just like you, hopefully, I have a life and I enjoy it. I will not bother you with what I ate this morning, the weather in New York, or the composition of my breakfast. If any personal details are revealed it is because I think that they are related to the point I want to make and would add color to my point.

I tell the truth and will not lie. Ever. I might not tell you some parts of truth that I find, since it might shock you (economist are known for spoiling other people's mood at parties, so I won't do that), but in any topic I attack, my full perspective will be

In fact, for at least 20 years I wanted to write a book (and I will) about life. One book. It would be a good thing to have for the next generations. It seems to me that the truth is out there, but it's hard to find. I have found big chunks of truth in many books and I wanted to squeeze all this wisdom into one book to make it available to humanity (not for free of course... stay tuned). This blog is free of course, but I use it for my own selfish reasons, namely to practice writing for my book and crystallize some of my thoughts. As the romans said: "verba volant, scripta manent" (from Caius Titus - words fly, but writing stays).

I like history and I read a lot. I have a long commute to work, which I use to read the pearls of wisdom that I accumulated in my library. I hope that you will accompany me in this journey.

Explanation for references to Mythrans

For this reason, discussions of dogma will be avoided as much as possible in this forum. However, in evaluating some people's behaviors and actions, the religious motivation can not be denied. Moreover, it can explain most of the behavior that seems so outlandish to the rest of us.

I personally find the lack of proof for the existence of the supernatural sufficient to reject this hypothesis. However is not my business to change other people's minds and stay out of other people's business as long as religion is their private business.

I try however to be objective and want to look at things as if I were from a far away planet with 24/7 access to earthly issues.

For this reason, I will call the religion that makes the headlines all across the world, the cult of Mythras (the real cult of Mythras is extinct since 5th century).

But which is the cult of Mythras? If you read the newspapers this morning, perhaps you noticed that one of the followers of Mythras has committed some atrocities against other people. Mythrans are those who are always get upset at non-Mythrans for the faintest transgression, while they themselves put no boundaries to their behavior.

Now you know who I am talking about.

Wednesday, January 12, 2011

Using Cut, Copy Paste on Mac OS X on a Typematrix 2030 keyboard

I know I don't usually discuss technology or personal issues on my blog, but I think this is important for Mac and Dvorak users who want to use a top-notch keyboard as TypeMatrix 2030. TypeMatrix is a very comfortable keyboard with keys arranged in a rectangular pattern (not staggered - like the 1800 - type keyboards still on the market). It is very comfortable, and when using the Dvorak layout, you can save thousands of hours typing very quickly and reducing RSI injuries.

The problem for the Mac users is that the Cut, Copy and Paste buttons in don't work on TypeMatrix.

There are three solutions - all include installing the newest version of KeyRemap4MacBook. You can find it here. Note: install version 7.0.38 or later, not the version 7.0.0 which is available in the source code section (as of now, Jan 13, 2011). More info about the software - here.

Option 1 (recommended): The latest version of KeyMap4MacBook has been modified to make this a breeze.

First install KeyMap4MacBookPro. Make sure you are in Dvorak layout in Mac OS X. This can be done in Language & Text. Select Input Sources tab and Select Dvorak. Then:

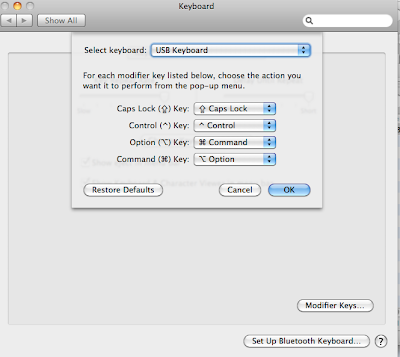

a) Open System Preferences. Select Keyboard. Under Keyboard Tab, select modifier keys. Make sure you select USB Keyboard from the top drop down box. Replace Option with Command and Command with Option. This way the Command key (⌘), which is very much used on Mac OS X is the key labeled alt on TypeMatrix (both on the left and on the right). The Option key (⌥) becomes the key labeled start on the bottom row on the left.

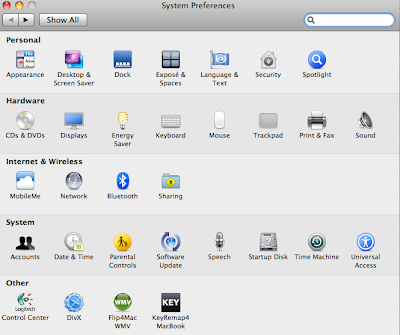

b) Open KeyRemap4MacBook (it is in System Preferences, at the bottom, under Other).

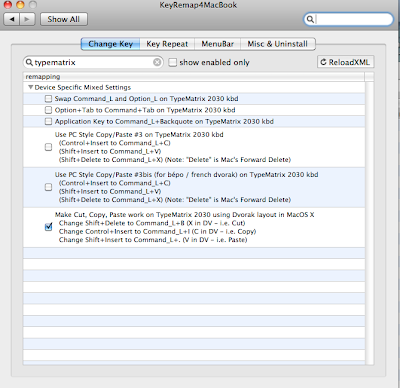

c) type typematrix in the KeyRemap4MacBook search box. Select the bottom option.

c) type typematrix in the KeyRemap4MacBook search box. Select the bottom option.

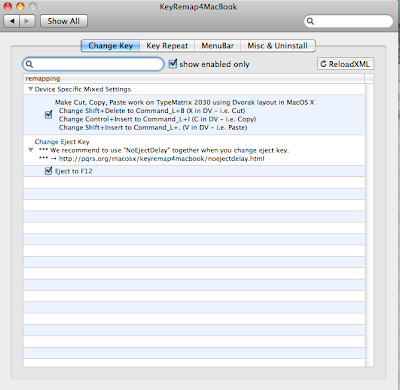

On KeyRemap4MacBook there are instructions to ensure there is no delay in ejecting the disk. See the link here.

e) Now there is 1 tweak left (please skip this step if you don't want to use F12 to eject the CD tray):

Remap Dashboard to other F key. I used F6. Go to System Preferences, Keyboard and select Keyboard, then Select Keyboard Shortcuts tab.

Go to the first option on the left pane: Dashboard & Dock. Double click on Dashboard option on the right. As the line gets highlighted in blue, click F6 (or whatever you want to map it to).

Done!

This way you can use Dvorak on your Mac, directly from Mac OS X, without any other changes. It will work perfectly every time. Your OS X will have the Dvorak layout and you need no other options from the keyboard.

Option 2 (not recommended): Install KeyRemap4MacBook. Set the language in Mac OS X to American (that is QWERTY) and set the TypeMatrix on Dvorak using the hardware switch. The disadvantage is that you have to set it to Dvorak on TypeMatrix every time you turn on the computer on. That can be annoying after a while.

Here are the settings in KeyRemap4MacBook:

Option 3 (not recommended): Use Dvorak - Qwerty ⌘ language in Mac OS X. So there is no need to use TypeMatrix hardware switch.

This way the Operating system knows that it is in Dvorak, but once Command (⌘) key is pressed, the OS behaves like QWERTY - so all the usual shortcuts are in the same position as they are on QWERTY.

Use the same settings in KeyRemap4MacBook as in option 2.

This way, the Cut, Copy and Paste dedicated keys on TypeMatrix work, but you have weird shortcuts that don't make any sense for any Dvorak user.

Tuesday, December 8, 2009

The foolishness of Estate Taxes

Dear Ms. Francis,

I am a great fan of yours. I read your “Underground Nation” and I was really impressed by the way you can clearly see the negative consequences of government intervention in the economy.

We all know that the government does not do a good job at administering its assets and that billions of dollars are wasted annually on useless if not harmful pet projects. Second best but a close one is the use of private money for charitable purposes. However we all know that most charities, even if they are Bill and Melinda Gates' charity, are spending a sizable share of their budget on administering their funds.

Some charities sometimes spend 70-90% of their budget on administration (including these silly half an hour advertisements on TV) and the rest they give away.

This is by any definition an industry.

Setting up such a trust or charity before your death will accomplish little. Some charities (like Rockefeller’s) are growing their assets over time. Their real purpose is to provide salaries for their administrators and not to champion their causes that created them in the first place.

On the other hand any economist knows that in deciding on how much to consume or to invest, a rational citizen is trying to maximize an infinitely long string of consumption, of course discounted deepening on your time preference. You have a preference to leave some money to your family so they can enjoy themselves and grow.

An estate tax, therefore trims considerably the potential for consumptions for your offspring and in the consumption- investment balance, the tendency goes more towards consumption, therefore reducing potential production in the future. Therefore less capital will be available for the future generations. If this is the price to pay for having an elite in America, I think that it is worth it.

The estate tax is clearly a socialist invention. The tax does not apply equally to all citizens. Why should there be a $2 million dollar exemption on the value of the estate is not clear to me. How about a $10,000 exemption and a flat rate on the difference?

I want to see how many people will go out and cheer for the estate tax.

It is true that there is some positive side effect to the estate tax (like Gates or Buffet giving out their money to the public), but this a much worse alternative than no estate tax. Gates and Buffet although the first and second richest people in the world, have less wealth than Toronto produces in a couple of months, a drop in the bucket compared to the worldwide or American wealth. I don't see why other rich Americans should live their life by the ideas of Gates/Buffet. These (other than Buffet/Gates) rich Americans don't want their wealth taken away by the state or don't want to make their name "immortal" by donating their money to charity. They want to keep their money in the family.

Let's imagine for a second that there is a 100% estate tax. How much capital will there be available for the next generation? I bet that all rich people will buy annuities and spend like drunken sailors. Trillions of dollars of capital would be wasted in less than 50 years.

Clearly the estate tax is not a good thing. I am not a rich man and I probably never will, however I want a lot of people to have money around me and save them if they are so inclined. The estate tax in US in a bad thing and I hope that the Republicans will repeal it as soon as possible. Everybody would be better off.

Dear Diane, I would also want to transmit my thoughts to Bill Gates and Warren Buffet and to tell them that I laugh at their attempts to have the estate tax increased. If they don't think that the tax is high enough and that Uncle Sam, will leave them with too much money in their pocket, I can give them my banking information and I expect a deposit from them.

Diane Francis original article

Tuesday, August 08, 2006

Bill Gates & Warren Buffett on Estate Taxes

The Republicans, fearing a bloodbath in this fall's mid-terms, have honed a cynical compromise. Most seem ready to agree to boost minimum wages by US$2.10 an hour to US$7.25 within a decade in order to camouflage their attempt to scrap estate taxes for a few thousand super wealthy.

But the camouflage isn't working, thanks to America's two richest individuals Warren Buffett and Bill Gates. Both are totally opposed to scrapping estate taxes which, by the way, Canada scrapped in 1972 and replaced with a 25% capital gains tax upon death or departure.

The two most successful men in the United States oppose scrapping estate taxes based on the indisputable logic that such taxes are absolutely essential in order to foster free enterprise.

This is because such taxes mitigate the creation of an elite which can control the economy and politics, thus removing opportunities for new, smarter players. Look at Latin America or Saudi Arabia if you think unfettered inherited wealth builds sound economies and good societies.

Warren Buffett described the rationale behind estate taxes best: "Repealing estate taxes is equivalent to choosing the 2020 Olympic Team by picking the eldest sons of the gold-medal winners in the 2000 Olympics."

He made that statement the day he announced that his wealth was mostly going to the Bill and Melinda Gates Foundation (and four smaller foundations to be run by his three children). The Gates Foundation finances social development and healthcare projects that governments and the private sector have neglected.

Mr. Buffett and Mr. Gates not only oppose scrapping the tax but favor increasing it. Gates' father, a Seattle attorney, leads the political movement in favor of higher taxes.

Despite the compelling logic, the Republicans seem to be listening to the lobbyists on behalf of the richest families who have spent US$500 million since 1994 lobbying to repeal the taxes, according to U.S. think tanks Public Citizen and United for a Fair Economy.

By the way, these estate taxes are rarely paid to governments. The wealthy have a choice: pay the money to the government or set up a bona fide foundation and give it away.

And that's another benefit derived from the taxes. These foundations fill a void that's often missing. These foundations and families divest their wealth to build hospitals, universities or to make contributions to social development projects, foreign aid schemes, public-interest research or the arts.

It's a win-win situation for the public.

And estate taxes are one of the main reasons why Americans are roughly four times' more charitable than Canadians on a per capita basis.

Currently, the taxes in the United States are punitive and can total 90% in some regions. There is a federal estate tax of 55% on estates worth US$2 million or more and, in addition, most state governments impose a death duty.

By contrast, Canada is unique among developed nations in that it has no estate taxes.

Worse than that, Canada also allows its wealthiest citizens to pay a 25% departure tax on wealth created in Canada and then move to tax-free or lower tax offshore havens forever so they never have to pay taxes again.

This is what Canadian families headed by tycoons such as Frank Stronach, Michael deGroote and the billionaire Irvings of New Brunswick, among others, have done with their wealth.

While this is not illegal, morality is another matter. People who have made fortunes should pay back the country that gave them the opportunity to become wealthy. So should their offspring and their offsprings' offspring.

By contrast, the U.S. taxes its wealthiest citizens when they die but also wherever they live even if they have renounced their citizenship.

Mr. Buffett, who lives in a house he bought for $31,500 even though he is the world's smartest stock market investor, also articulated estate taxes as an important cornerstone of social justice.

"It's in keeping with the idea of equality of opportunity in this country, not giving incredible head starts to certain people who were very selective about the womb from which they emerged," he said.

He chose the Bill and Melinda Gates Foundation to give his US$31 billion to because he said the couple has demonstrated that it knows how to do its due diligence so that its "giving" is leveraged and provides sufficient scale to make a difference.

The Gates' Foundation has a very small staff and prefers partnerships or networks as a giving strategy. But it is selective in how to hands out funds.

For instance, the Foundation has provided badly needed technology to 11,000 public libraries in the U.S. It has given US$100 million to 8% of New York City's public high schools providing they met certain curriculum criteria. And it just announced US$237 million in grants to several research groups to come up with a vaccine against AIDs providing they all agreed to cooperate and to share their results globally for others to work on.

http://dianefrancisbusinessissues.blogspot.com/

Sunday, July 19, 2009

Wednesday, June 17, 2009

Clive Crook from FT and Peter Orszag are wrong on government health care

I am referring to Clive Crook's article on Medicare and Peter Orszag's article.

I am a Financial Times temporary subscriber (as in I won't renew my subscription when it will come up). I think FT is a leftist piece. (which is curious since finance should be about markets).

The US system is very expensive, as noted by Peter Orszag today; but it does the job for most Americans.

What Obama and you have in mind is to replace the balkanized system that every state has with a monster federal system.

Crook says that a Medicare-for-all system would give US a truly universal coverage and will better control the costs.

Canadian experience, however, shows the exact opposite - a truly government system is absolutely unable to contain costs. Not only expenses increased from 77 billion CAD in 1997 to 177 billion CAD in 2008, but the quality improvement is nowhere to be found (that is I think the Canadian system at this moment is the worst ever). I lived in Canada until early this year - I know what I am talking about.

You must have near infinite patience to wait in the hospital emergency room. As for seeing your family doctor (1 million people out of 13 million in Ontario, Canada don't have one) it takes from a week to a few weeks. However, going from there to a specialist takes a few good months (unless you are connected with the mighty Ministry of Health bureaucracy). From a specialist to surgery it takes a few more months.

Also, in Canada, there were cases of women having miscarriages in the emergency ward (after waiting a few good hours for a help that never came). Look at this case in Alberta.

What Obama wants to do is to shove some kind of Medicare down everybody's throats. Of course he will say he only wants to improve accessibility and lower costs, but if history is any guide, Obama's talk and actions point in completely different directions. Actually if he really wants to make America competitive (as Orszag claims in his piece) there is a better solution: get out of the business altogether. Don't provide any medical services. Just pay for the handicapped and the elderly to provide their own care from a private hospital/practitioner.

But this won't fly. Obama's supporters in the nurses unions would not vote for him and he will lose his job come 2012. He would have to go back to community organizing, writing fluffy books and rubbing shoulders with Ayers and Wright. His wife also won't be able to be a trustee to a hospital associated with the University of Chicago, since Obama won't be able to direct pork from taxpayers to the above mentioned hospital.

What Orszag said today in FT is no news. We all know that the costs of medical insurance is up and it seems (to him) that prices have no chance of abating. And while it's true that US health care lacks in quality (especially from government hospitals), he fails to mention that the runner up regarding costs (Canada) is the worst in OECD in terms of "bang for the buck". US care is more expensive, but it achieves more. From this perspective, I note Orszag's comments as misleading.

What Orszag suggests is to

- ration care: reduce it by 700 billion a year.

How will he determine what is inefficient - he doesn't say. Maybe have a 800 billion dollar a year agency that can do that.

- cut payments to private insurers

So the insurers stop ensuring some procedures or better yet go bankrupt and let the government insurer take over.

- cut health deductions for the wealthy.

The rich don't even use the government health facilities. He also assumes that they won't actually move somewhere else or cut on their work (why work when the government gauges you).

- cut payments to hospitals for the uninsured

That's when Orszag shows his real colors. He assumes there would be few uninsured if any, since the government will pay for them with taxpayers' money.

- improve medical records

It was tried in other places (Ontario), where the government spent over 500 million, no work was done, but those in charge got hefty bonuses.

- changes in incentives (what changes - it's not clear).

Orszag's changes (and by extension, Obama's) don't even scratch the surface. It's like complaining that houses are too expensive when the interest rates are close to zero and sub-prime borrowers need no downpayment. The only solution then is to ask fannie and Freddie to lend more.

The simple fact of dropping employer chosen health plan would be the best thing possible - for starters.

What the healthcare system needs is a good dose of competition. Competition for insurers between state lines, a reduction in regulation regarding medical practice and a strong pressure on AMA (American Medical Association) to increase the number of medical students (or better yet, get rid of medical certification from AMA altogether). Also government discrimination against systems where the patients pay a fixed amount of money for care (while all costs are covered by the doctor/insurer). This in my opinion aligns perfectly the interests of the doctor (cut its cost) with the interests of the patient (good care). Tort insurance would also be useful (at least in capping the damages to a reasonable amount)

Milton Friedman wrote this great article in 1998. At the time he noticed that real costs of a day in hospital went from 30 dollars a day (in 1996 dollars) to 1200 in 1996. He also noted that the number of hospital beds per 1000 people went down as soon as the government programs of medicare and medicaid were implemented. The reduction in care produced a bureaucratization and an increase in number of nurses without any tangible benefit. Medical care professionals waste precious hours filling up papers for the government.

The share of government expenditure in healthcare is already 55%. Hardly a free market.

What incentives are there for providers of health services in a government system? None. As you might recall, in the US there was a scandal a few years back that soldiers coming from Iraq with serious wounds were "treated" in a dirty facility with rats (maintained by unionized workers of course). Also a family (I am sure it was not a singular case) was told that their loved one will never walk again, only to be treated in private facility and walk in a few months.

Everybody can see the problems of the US health system. However, looking at Obama plan (or whatever crums he and Orszag revealed to the underlings), it's clear that their medicine is worse than the disease.

It's seems to me that politicians enjoy using the machinery of the state to tax unwilling citizens only to redistribute the bounty with the other half (that is their voters). Sooner or later they will run out of other people's money. Then what?